Chapter 1: The Rise of Digital Payments

Over the past decade, the world has witnessed a complete transformation in the way people handle money. From buying groceries to paying utility bills, every transaction is now just a few taps away. This transformation has been driven by digital payments—and at the heart of this evolution lies the eWallet.

The Shift Toward a Cashless World

Traditional payment methods like cash and cards are being replaced by mobile-based solutions that are faster, more secure, and easier to use. The COVID-19 pandemic further accelerated this shift, as people began to prefer contactless and online payments over handling physical currency.

Countries like India, Singapore, and China have taken major steps toward building cashless economies, while global players like Apple Pay, PayPal, and Google Pay continue to set new standards in mobile finance.

Today, the term “digital wallet” is no longer limited to tech-savvy users—it has become a necessity for every smartphone owner.

The Growth of eWallets Globally

According to industry reports, the global mobile wallet market size is expected to reach over $16 trillion by 2030, growing at an annual rate of nearly 25%. This incredible growth is being fueled by:

• The increasing penetration of smartphones and internet connectivity

• The expansion of eCommerce and online services

• Government support for digital financial inclusion

• Rising consumer demand for faster, safer, and more convenient payments

This evolution has opened doors for startups, enterprises, and banks to invest in custom eWallet app development—creating opportunities for both business growth and financial empowerment.

The Role of Technology in Payment Innovation

The success of eWallets is rooted in technology. Modern eWallet applications are powered by advanced tools such as:

• Artificial Intelligence (AI) for personalized recommendations and fraud detection

• Blockchain for transaction transparency and enhanced security

• Cloud infrastructure for scalability and real-time data access

• APIs that connect banks, merchants, and payment gateways seamlessly

These innovations have made it possible to create secure, high-performing, and scalable wallet systems that handle millions of transactions every day without fail.

Why Consumers Love eWallets

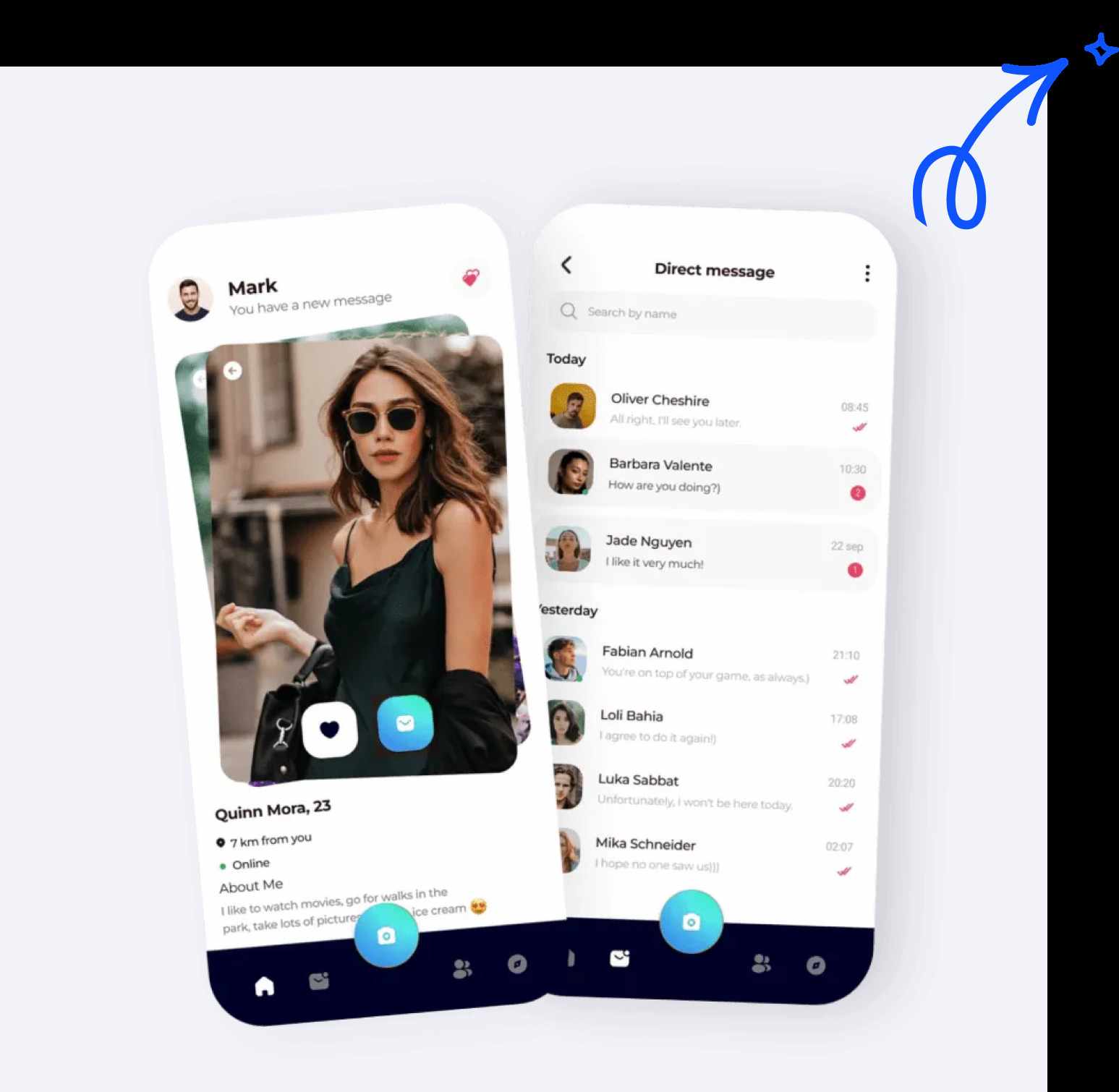

Consumers now value convenience and security more than ever. With an eWallet, they can:

• Make payments instantly without cash or cards

• Store multiple cards and bank accounts in one place

• Track their spending through transaction history

• Enjoy rewards, cashback, and offers from partner merchants

• Experience safer transactions with encryption and biometric login

The simplicity of use and the added layer of protection make eWallets a preferred choice for daily financial management.

How Businesses Are Benefiting

For businesses, eWallets are not just a payment option—they’re a strategic advantage. Integrating a digital wallet system helps companies:

• Offer faster checkout and improve customer satisfaction

• Reduce dependency on third-party payment processors

• Gain customer insights through data analytics

• Build stronger loyalty programs

• Enhance brand credibility by embracing innovation

Every business, from small retailers to global enterprises, is now realizing that digital payment integration is the key to long-term success.

The Emergence of eWallet App Development Companies

As demand for digital wallet apps grows, the role of eWallet App Development Company like Techanic Infotech has become crucial. These companies design, develop, and deploy high-performance wallet applications that are secure, scalable, and feature-rich.

At Techanic Infotech, our focus is on building custom eWallet apps that blend technology, usability, and trust. We help businesses step confidently into the digital era with solutions that match their vision and market goals.

The Road Ahead

Digital payments are not just transforming how we pay—they’re reshaping the entire financial ecosystem. From local markets to international trade, from personal banking to enterprise finance, every transaction is becoming digital, faster, and smarter.

In the coming years, technologies like AI, blockchain, and voice-based payments will continue to redefine how eWallets function—making them even more integrated with our daily lives.

Conclusion

The rise of digital payments marks the beginning of a new financial era. The convenience, speed, and security offered by eWallets have made them indispensable in both personal and business finance. As this revolution continues, companies that adopt eWallet technology early will lead the way in customer satisfaction and innovation.

At Techanic Infotech, we believe that the future of money is digital—and we’re here to help businesses unlock its full potential.

In One Line:

The future is cashless, connected, and powered by innovation—and eWallets are leading the way.

Write a comment ...